Overview

- Brand Type: Home & Kitchen

- Marketplace: Amazon.com (U.S.) and Amazon EU

- Timeline: Launched in the U.S. market in 2021

- Initial Market: Amazon EU

- Goal: To establish the brand in the U.S. market, grow profitability, and dominate their niche.

Market Insights

- Seller Statistics: Only 2.1% of Amazon sellers make over $10 million annually. The average annual profit for sellers is nearly $30,000.

- Growth Path: Success on Amazon is often a slow and steady process, with gradual growth being more common than explosive success.

Product and Market Positioning

- Product Characteristics:

- Category: Broadly classified as Home & Kitchen, but within a very specific niche that lacks a dedicated subcategory.

- Price Range: $20-$40, making it an impulsive purchase for many buyers, with partly seasonal demand.

- Size: The product is not oversized, keeping FBA fees manageable.

- Market Niche: Not oversaturated, allowing the brand to stand out.

- Initial Challenges:

- Stolen ASINs in the U.S. market, leading to the need for new ASINs.

- Keyword issues relating to “pesticides,” which delayed listing approval.

Phases of Growth

Phase 0 – Pre-Launch

- Goal: Prepare listings and solve logistical challenges before entering the U.S. market.

- Actions:

- Fought to reclaim ASINs after they were stolen.

- Resolved keyword-related issues that flagged the product as “pesticide-related.”

- Launched with new ASINs, SEO-optimized listings, infographics, and A+ content (A++ was unavailable at the time).

- Over 100 SKUs were unblocked, allowing for the first batch of stock to be sent to Amazon.

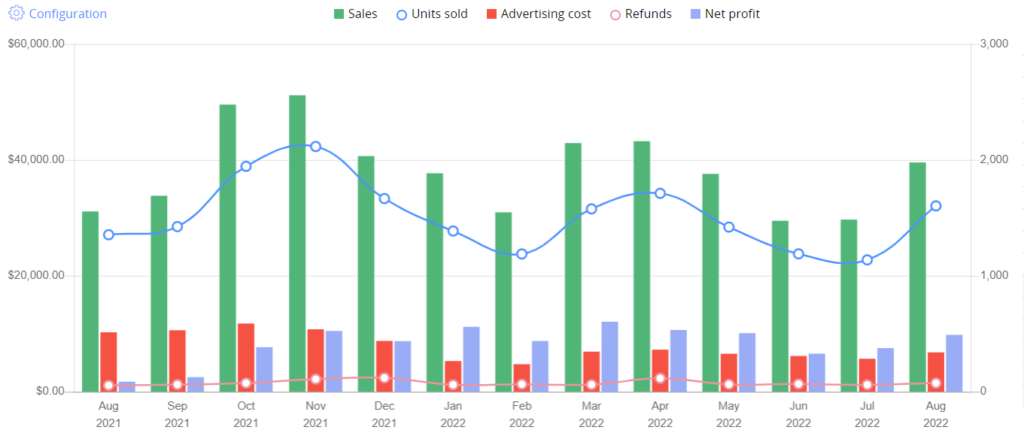

Phase 1 – Product Launch (0-6 months)

- Strategy: Building product visibility through a robust PPC strategy despite an expected 0% profit margin during the launch phase.

- Actions:

- Launched with 10-15 parent variations, targeting the top 5-10 main keywords.

- Separated keywords and competitors into dedicated ad campaigns, focusing on ranking and indexing.

- Ran exploration campaigns targeting 20-30 keywords and competitor ASINs.

- Implemented Auto, Broad, and Phrase match campaigns for deeper keyword exploration.

- By the end of 6 months, the brand had stabilized, although it was still operating at a 0% profit margin.

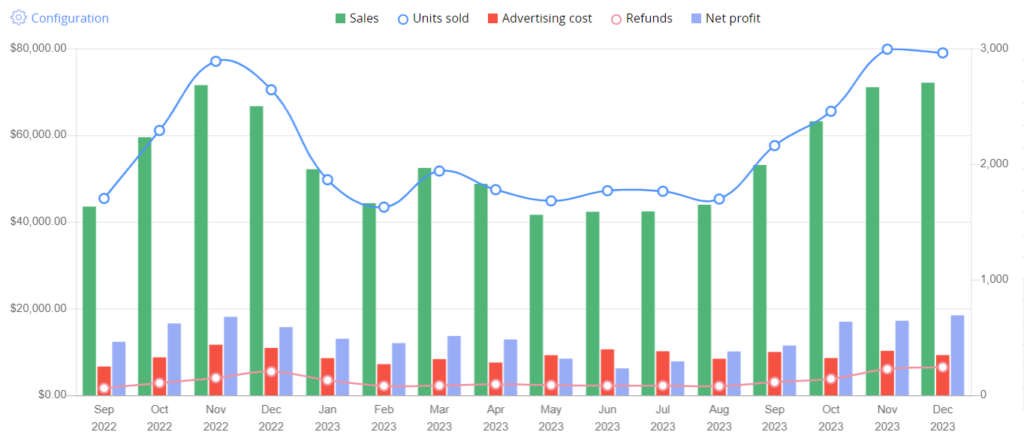

Phase 2 – Growth Phase (6-18 months)

- Strategy: Expanding visibility and establishing profitability.

- Actions:

- Utilized a strong Defence strategy to protect product pages from competitors by ensuring the brand’s ads appeared in all possible ad spots.

- Dominated top search terms by separating individual targets into their own campaigns for maximum optimization.

- Focused on Sponsored Product campaigns to further boost organic ranking.

- Seasonal demand during the winter months helped boost performance.

- Results: By the end of the phase, the brand was averaging $10,000 in monthly profit.

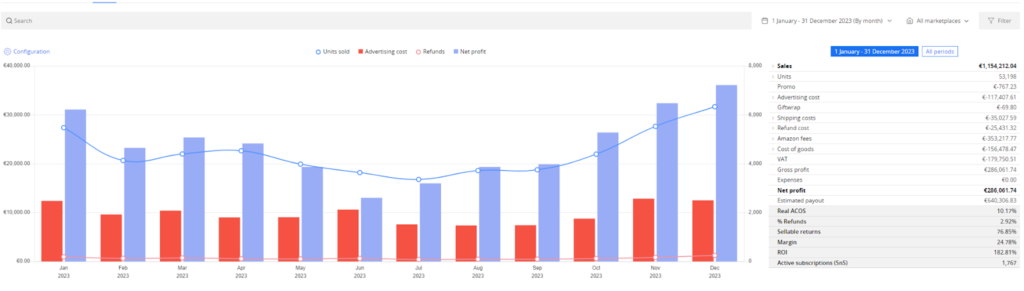

Phase 3 – Cash Cow Phase (18+ months)

- Strategy: Maintaining market dominance and focusing on profitability through Sponsored Brand and Display campaigns.

- Actions:

- Upgraded A+ content to premium and added a brand story to further establish trustworthiness.

- Continued testing new keywords and improving product quality, content, and manufacturing.

- Aggressively defended against new competition by targeting competitor ASINs and keyword bids.

- Results:

- By 2023, the brand was consistently generating an average of $14,000 in monthly profit.

- Expanded into Amazon Canada, generating around CAD 7,000 in monthly profit after overcoming compliance and logistical challenges.

Conclusion

- Dominated Niche: The brand successfully saturated its niche, achieving its goals of market dominance and profitability.

- Future Growth: With limited room for growth in the current niche, the brand is exploring new products and natural niche expansion.

- Key Takeaway: Success on Amazon requires patience, investment, and long-term dedication. Brands must understand the product lifecycle and be prepared for slow but steady growth.